Taurian MPS IPO Date, Review, Price, Allotment Details

Taurian MPS IPO will open on September 8, 2025, and close on September 10, 2025. It is a Book Built Issue through which the company plans to raise approximately ₹42.53 crores, consisting entirely of a fresh issue worth ₹42.53 crores along with an offer for sale of up to [.] equity shares, each having a face value of ₹10.

The IPO price band has been set at ₹162 to ₹171 per share. The allocation quota is 35% for retail investors, 50% for QIBs, and 15% for HNIs. Taurian MPS IPO is scheduled to list on the NSE SME on September 15, 2025, with the allotment date fixed for September 11, 2025.

In terms of financial performance, the company recorded revenue of ₹73.70 crores in 2025 compared to ₹44.17 crores in 2024. Its profit stood at ₹9.50 crores in 2025, down from ₹11.32 crores in 2024. Considering the financials, the IPO is recommended for investors with a long-term perspective.

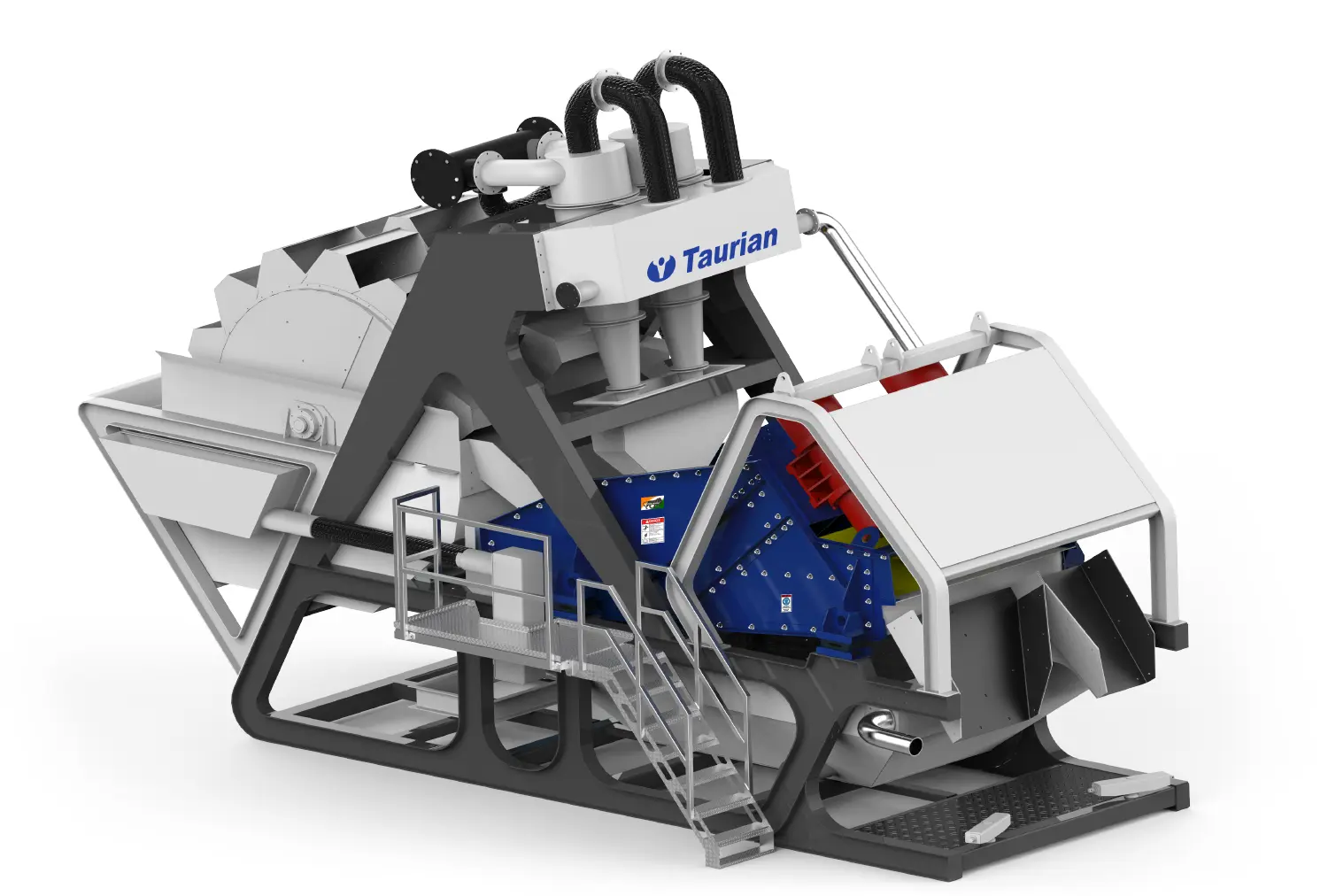

Taurian MPS, established in 2010, is a leading engineering and manufacturing company specializing in crushing, screening, and washing plants, spare parts, and complete industrial solutions. Its product portfolio includes crushing and screening plants, washing plants, hybrid track crushers (Terra Track series), modular Swift series, and Wheeler series equipment. These products cater to diverse industries such as mining, construction, food processing, and waste management. The company also manufactures CE-certified crushers capable of handling up to 1,200 TPH.

The company operates a 64,773 sq. ft. manufacturing facility in Roorkee, Uttarakhand, equipped with advanced processing systems and robust after-sales support. It has established a strong presence across more than 15 states in India and expanded internationally with dealers in the Gulf, Caribbean, and USA, along with sales in Mexico, Tanzania, and Jamaica. As of January 31, 2025, Taurian MPS employs a total of 94 people.

Taurian MPS IPO Details:

Face Value

₹10 Per Equity Share

Fresh Issue

Approx ₹42.53 Crores

Ipo Date

September 8, 2025

Issue Price

₹162 to ₹171

Issue Type

Book Built Issue

Listing At

NSE SME

Listing Date

September 15, 2025

Listing Day Close

--

Listing Day Gain

--

Lot Amount

₹2,73,600

Lot Size

800 Shares

Offer For Sale

--

Price Band

₹162 to ₹171 Per Share

Profit Loss

--

Share Holding Post Issue

--

Share Holding Pre Issue

--

Total Issue Size

Approx ₹42.53 Crores

--

--

Taurian MPS IPO Timeline (Tentative Schedule)

Basis Of Allotment

2025-09-11

Credit Of Shares To Demat

2025-09-12

Cut Off Time For Upi Mandate

--

Initiation Of Refunds

2025-09-12

Ipo Close Date

2025-09-10

Ipo Open Date

2025-09-08

Listing Date

2025-09-12

Key Performance Indicator

KPI

Values

Debt Equity

0.27

P Bv

--

Pat Margin

12.92

Roce

31.64

Roe

35.44

Ronw

27.69

Objects of the Issue (Taurian MPS IPO Objectives)

Taurian MPS IPO Review (Apply)

Taurian MPS IPO Company Financial Report (₹ in Crores)

Company Promoters

Upcoming IPO

SME IPO

The ultimate destination for all of your medical needs.