Manas Polymers IPO Date, Review, Price, Allotment Details

The Manas Polymers IPO will open on September 26, 2025, and close on September 30, 2025. This is a Book Built Issue aiming to raise approximately ₹23.52 crores, which includes a fresh issue of ₹23.52 crores along with an offer for sale of [.] equity shares, each with a face value of ₹10.

The price band is set between ₹76 and ₹81 per share. The IPO allocation comprises 35% for retail investors, 50% for Qualified Institutional Buyers (QIB), and 15% for High Net-worth Individuals (HNI). The shares are scheduled to list on the NSE on October 6, 2025, with the allotment date fixed for October 1, 2025.

Financially, the company reported a revenue of ₹5.03 crores in 2024 and a profit of ₹0.79 crores in 2024. Considering these financials, long-term investment in this IPO is advised for investors.

Founded in 2015, the organization has made huge strides with a remarkable presence in the “PET(Plastics) Industry” and “Solar Energy Industry”.

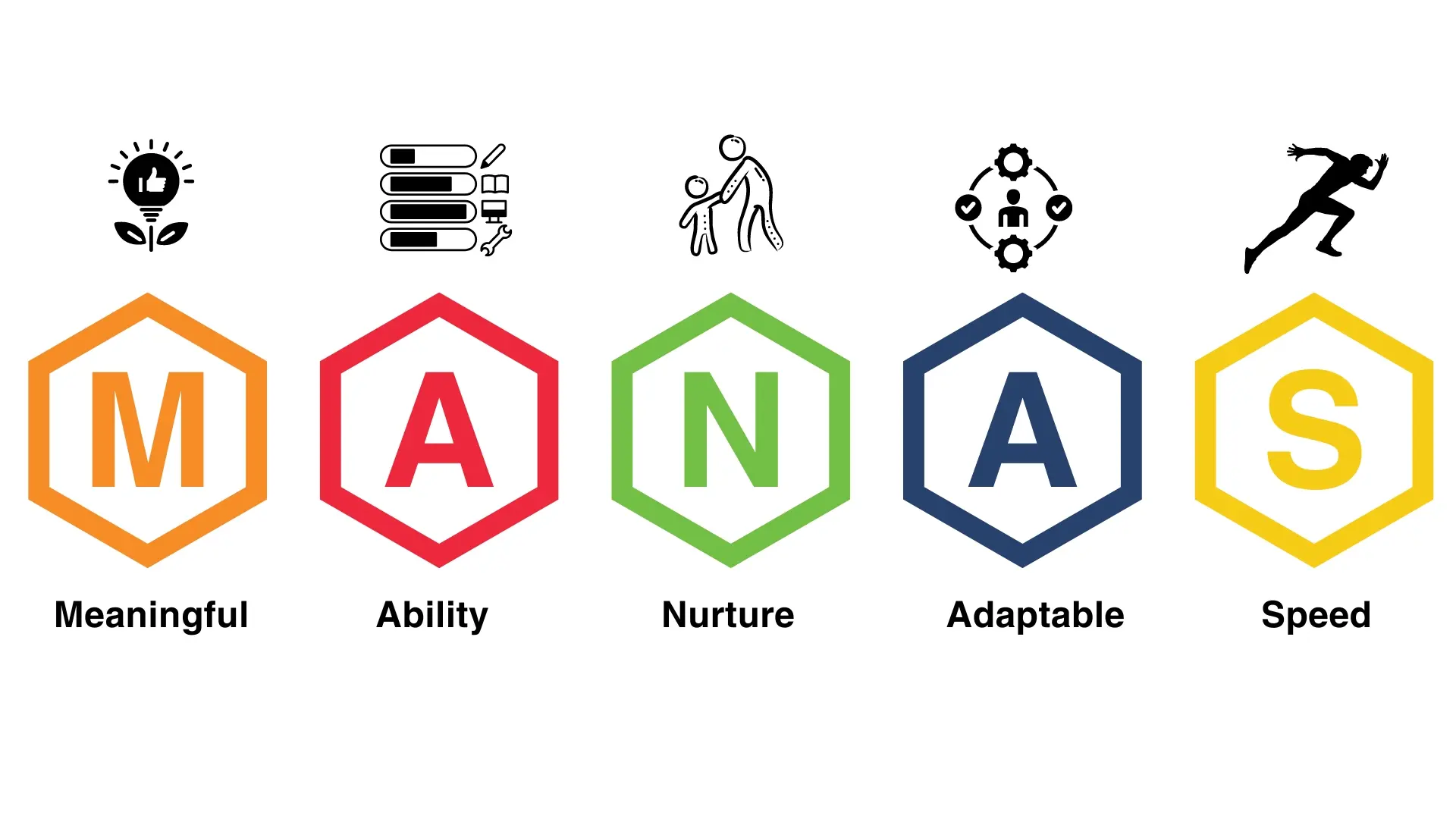

Having established as a prominent figure in the PET Industry (manufacturing and supplying premium food grade PET Preforms, PET Bottles and Closure Caps), we are ready to take the giant leap towards becoming the market leader in this segment by strictly adhering to our VALUES

Manas Polymers(MPEL) is a consumer focused organization delivering high quality PET Products for the Indian food and beverage industry. We possess a state of the art manufacturing facility backed by fully automated injection moulding technology working at the capacity of 4000 mt per year to cater to your packaging requirements and renewable energies solutions.

Manas Polymers IPO Details:

Face Value

₹10 Per Equity Share

Fresh Issue

Approx ₹23.52 Crores

Ipo Date

September 26, 2025

Issue Price

₹76 to ₹81

Issue Type

Book Built Issue

Listing At

NSE SME

Listing Date

October 6, 2025

Listing Day Close

--

Listing Day Gain

--

Lot Amount

2,59,200

Lot Size

2

Offer For Sale

--

Price Band

₹76 to ₹81 Per Share

Profit Loss

--

Share Holding Post Issue

--

Share Holding Pre Issue

--

Total Issue Size

Approx ₹23.52 Crores

--

--

Manas Polymers IPO Timeline (Tentative Schedule)

Basis Of Allotment

2025-10-01

Credit Of Shares To Demat

2025-10-03

Cut Off Time For Upi Mandate

2025-09-25T23:30:00.000Z

Initiation Of Refunds

2025-10-03

Ipo Close Date

2025-09-30

Ipo Open Date

2025-09-26

Listing Date

2025-10-06

Key Performance Indicator

KPI

Values

Debt Equity

2.02

P Bv

--

Pat Margin

9.92

Roce

27.96

Roe

33.37

Ronw

33.37

Objects of the Issue (Manas Polymers IPO Objectives)

Funding of capital expenditure requirements towards setting up of Solar Power Plant

Funding of capital expenditure requirements towards purchase of Fixed Assets

General Corporate Purpose

Manas Polymers IPO Review (Apply)

Manas Polymers IPO Company Financial Report (₹ in Crores)

Company Promoters

Upcoming IPO

SME IPO

The ultimate destination for all of your medical needs.